It’s easier and cheaper to sell more to existing customers than to obtain new ones. We show you how to calculate customer lifetime value to see how you can improve your retention rate.

Customer retention is essential for a lot of businesses.

You don’t want to be dropping customers through churn as it’ll mean you’re scrambling to make the difference with new customers every month.

It costs as much as five times as much to get a new customer than it does to keep an existing one.

So you can see, there’s a clear reason to put the effort into retention.

One great way to measure your retention and the profitability of your customers is through customer lifetime value.

This is a key metric used by many businesses to measure how much a customer is worth to them.

Keep reading to learn more about:

Customer lifetime value is the total amount of spend by a customer from their acquisition to the end of their relationship with a business.

Customer lifetime value (CLTV) is a metric that shows the total amount of revenue a business can expect to generate from a single customer throughout their entire lifetime.

This is an average value that considers their predicted lifespan, plus how many times that user purchases and for how much.

The more a customer spends, and the more they purchase, the greater their lifetime value becomes.

This is a metric commonly used by customer success teams as it can indicate issues within the customer journey.

Related: Complete guide on customer journey stages

However, it’s also valuable from a broader business perspective.

You could break down your customer lifetime value into categories, such as industry, or location, to find out where to concentrate your marketing and sales efforts.

By having greater detail on what works best, and for who, you can make positive changes to drive more for your bottom line.

Understanding your customer lifetime value is the first step. We’ll come onto that in a moment.

But taking the time to measure it is important for a number of reasons:

Let’s look at these in more detail to explain.

Does it seem like your CLTV is consistently low? That could be a cause for concern and you need to take quick action to address it properly.

It might be that you need to implement a better loyalty strategy, or a customer service programme to help users get more from you.

Step one is measuring your overall CLTV. Then, you will want to break down your customer lifetime value by key segments.

You could look at industry, location etc. Breaking down and measuring the CLTV for these areas will start to paint a picture of where your most profitable customers are. This will help your customer success team know who to pay the most attention to.

Leading on from the previous point, your sales and marketing team will get a better understanding of who they’re best to target.

You’ll know which customers stay longest and spend the most, and that’s great intel for the rest of your business to get more targeted with their approach.

The longer a customer stays with your business, the more they spend.

Plus, now your teams know who is best to target, so you’re getting better-quality leads in the first place! All of that has an impact, and good news, it’s going to make your bank balance even healthier.

Since you’re doing all this hard work, of course, you’re going to see further benefits. Now you’re focussing on the customers you know will stay, your customer acquisition costs will likely go down too.

Look at it like this, you’re spending less money and less time on people you know won’t stay or spend long-term.

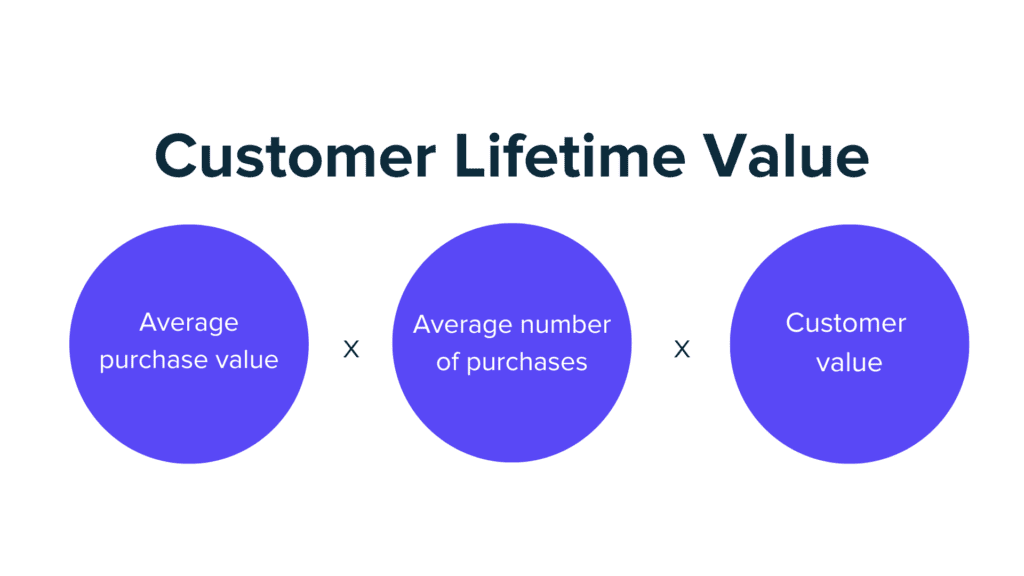

The formula for customer lifetime value is simple.

To calculate it, you need to work out your average purchase value and then multiply it by the average number of purchases. This is your customer value.

Then, once you have your customer lifespan, you can multiply that by your customer value.

In theory, it sounds pretty easy.

But getting each of these figures isn’t quite a walk in the park.

Let’s break down each part of the formula so you know exactly how to calculate CLTV.

🚀 Pro Tip

We asked the experts for help on CLTV. Read their top tips on how to increase your customer lifetime value, to get more from your current customers.

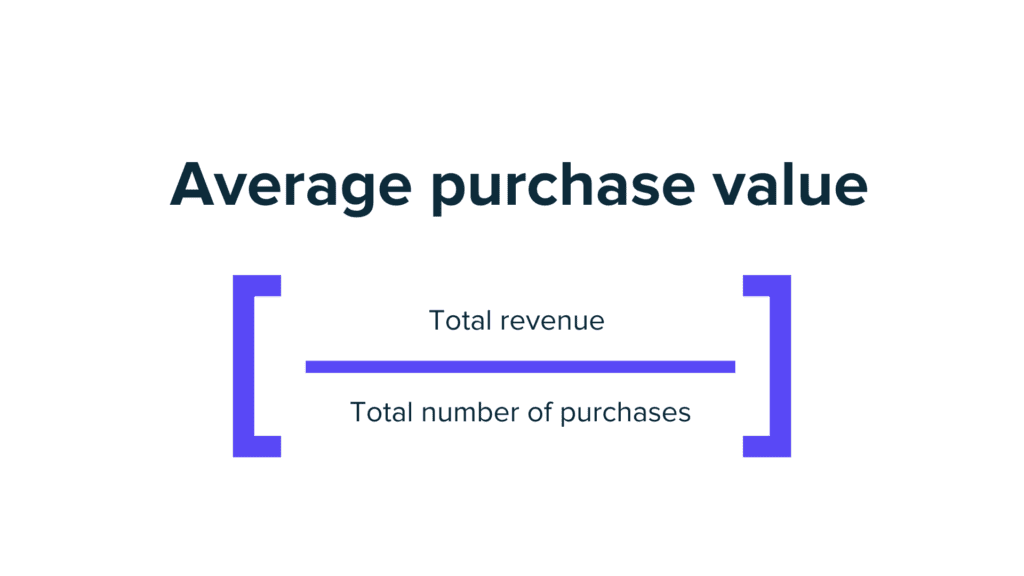

For the first part of CLTV, you need to know your average purchase value. This might feel overwhelming but calculating it is simple.

All you need to do is find out the total revenue your company took in a particular period, usually a year, and divide it by the total number of purchases made in that same period.

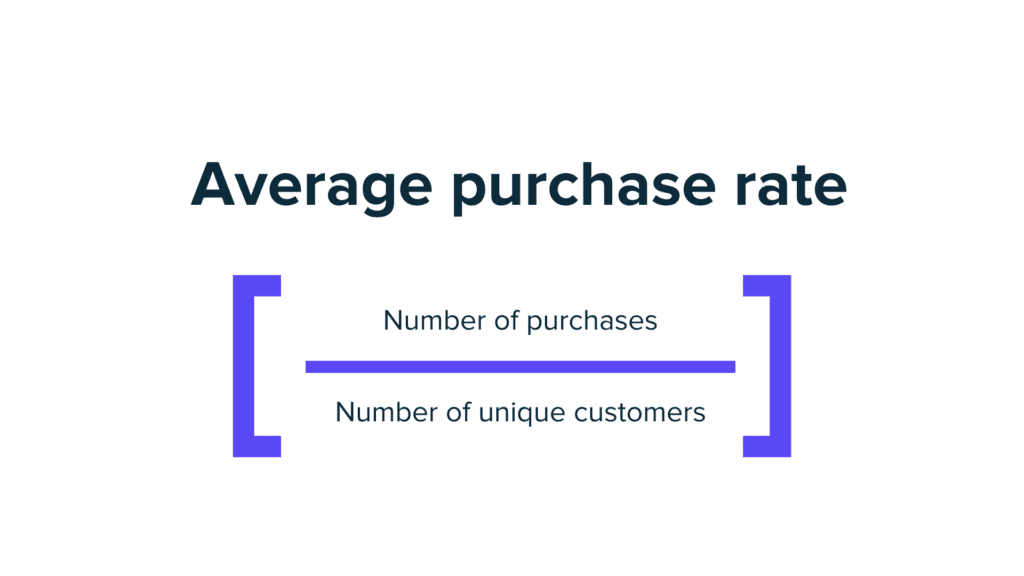

This should hopefully be a simple one. Take the number of purchases made in a particular period, and divide it by the number of unique customers who made purchases. So for example, if Company A made 10 purchases, they still only count as 1.

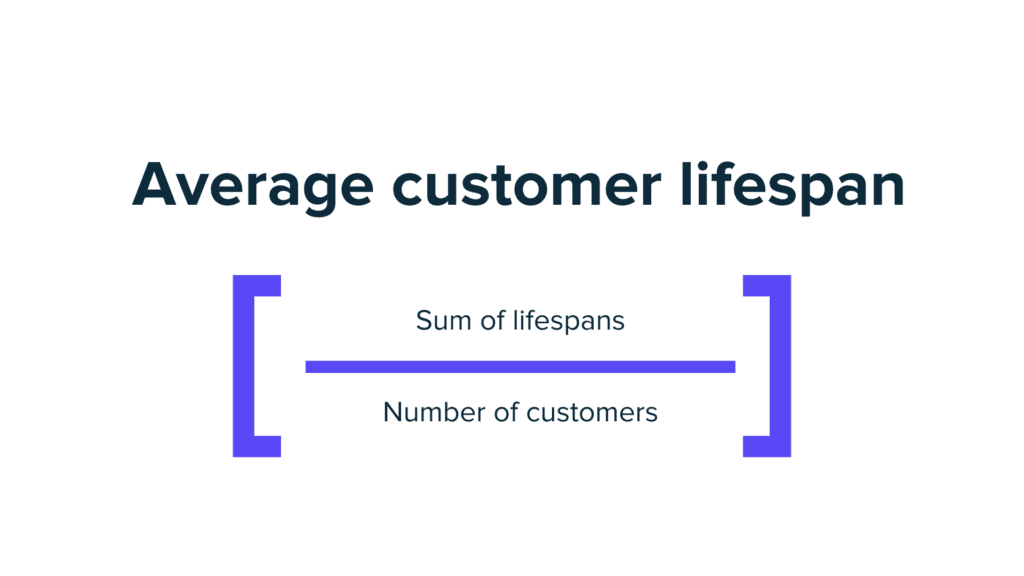

Lastly, multiply your average purchase value by your average purchase frequency rate. This should give you all of the parts of the formula that you need to calculate CLTV.

Remember, calculating this should be easy and it should form part of your regular reporting.

It’s a great way to get your teams aligned on who is important to your business so that you can create a deeper strategy to find more customers like them, plus engage with the right customers to encourage even more loyalty.

And remember, having the right reporting tool can make calculating your CLTV even easier. Learn how Ruler can help you optimise your marketing by giving you the data you need to make effective strategy changes.

Want to learn more about key marketing metrics and reporting? We share regular newsletters on reporting and marketing optimisation. Sign up to be kept in the loop.