Data sits at the core of any marketing strategy that works. It shows what’s working, what isn’t, and where to focus next.

Additionally, it powers targeting, helping you build audiences that actually reflect who’s interested in what you’re offering.

But not all data works the same way. Some types are more accurate, more useful, and more aligned with today’s privacy standards.

That’s why the long-running debate between first-party and third-party data still matters, and arguably matters more now than it did a few years ago.

As cookies disappear and regulations tighten, knowing the difference between first- and third-party data, and how to use each, can shape how well your campaigns perform.

In this post, we’ll break down what sets first-party data apart, why third-party data’s losing ground, and how you can build a first-party data strategy that supports measurement and targeting.

We’ll discuss:

💡 Pro Tip

With Ruler’s first-party tracking, you can track UTMs, click IDs, page views, and referrers. These data points are linked to user actions like calls, chats, or form submissions and are seamlessly integrated into your CRM. This allows marketers to clearly see which channels and campaigns are generating actual, closed revenue.

Book a demo and start your first-party data journey today

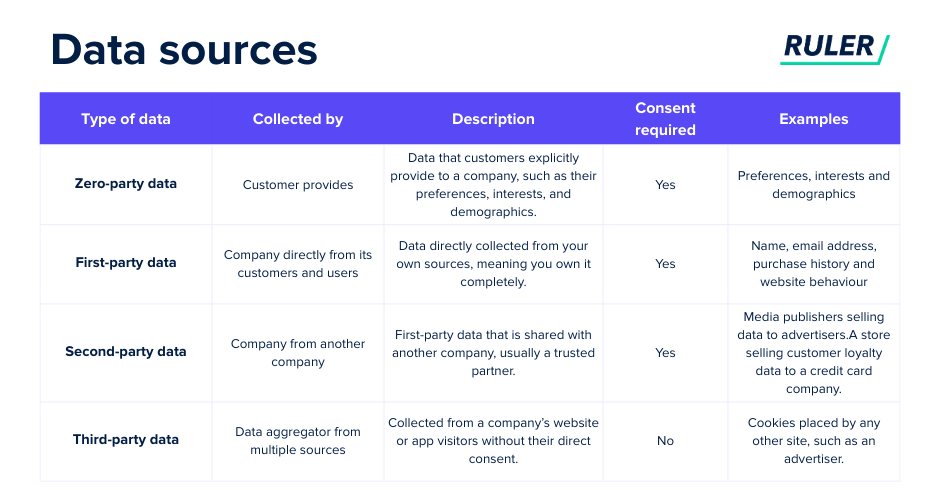

First-party data is the information you collect directly from your audience via your own channels, no middleman involved. This includes things like:

Because this data comes straight from your audience engaging with your brand, it’s highly specific to your business context. No assumptions, no guesswork – just real signals from real interactions.

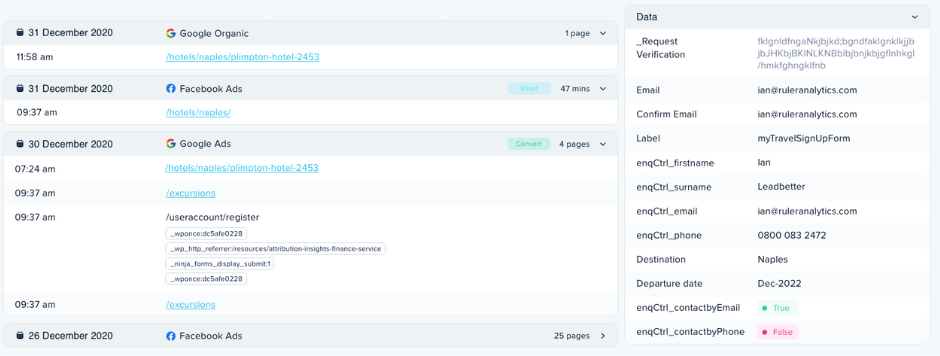

Take Ruler as an example. Ruler’s tracking tag picks up UTM parameters, source info, click IDs, and logs all that against conversions like form submissions, phone calls, purchases, and survey data.

Related: How to View Full Customer Journeys with Ruler Analytics

It links this to a person (say, with an email address from a form) and pushes it into your CRM. So now you’ve got a lead with marketing data attached – how they found you, what they clicked on, what they did next.

That makes it easier to map the full journey, from first click to stuff that happens offline, like demos and sales calls. Even revenue, if you’ve got that wired up (more on this later).

Now, compare that to third-party data, which is gathered by external sources that have no direct relationship with your users. This kind of data is:

Third-party data’s different. You essentially don’t collect it, someone else does. Usually data brokers or big ad platforms.

It’s aggregated from all over the web, sold in bulk, and grouped into segments like “sports fans” or “frequent travelers.”

It’s useful for reach, but you don’t know much about the individuals. And you can’t always trust where it came from or how fresh it is.

Then there’s second-party data. That’s basically another company’s first-party data that they share with you. Maybe through a partnership or a platform deal.

You don’t own it, but you’ve got permission to use it. Less common, but it shows up in some B2B setups.

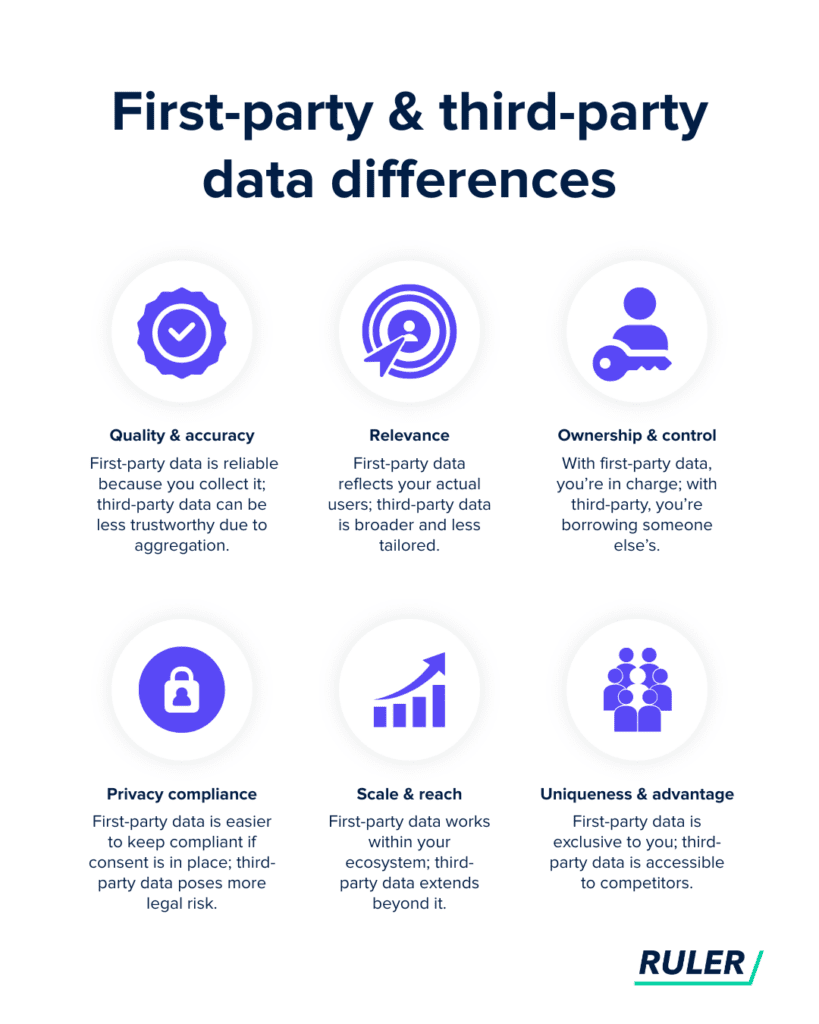

The gap between first- and third-party data isn’t just about where it comes from. The way these two types of data perform in practice is very different.

So while both types have their place, the balance is shifting. First-party data is becoming a more strategic asset.

The future of third-party data is looking uncertain.

Related: What does the future hold for third-party cookies?

Google has backed away from its original plan to phase out third-party cookies in Chrome.

It’s no longer pushing a new opt-out mechanism but says it will continue offering users cookie choices the same way it does now.

For now, that means marketers still have access to third-party cookies in the world’s most popular browser – Chrome held over 66% of global browser market share as of February 2025.

How long that lasts is unclear. But the landscape is already different elsewhere.

Safari and Firefox block third-party cookies by default, and they have for a while.

That has cut off a major pipeline for cross-site tracking, retargeting, and attribution models that depend on third-party cookie-based mechanisms.

It’s not just browser policy driving the shift. Regulation keeps tightening too.

GDPR in the EU, CCPA and CPRA in California, and other new privacy laws around the world keep raising the bar for data collection, sharing, and use.

Third-party data carries more compliance risk now, especially when it’s unclear how the data was collected or what consent (if any) was in place.

Apple’s App Tracking Transparency (ATT) framework has also changed mobile tracking.

Apps now need explicit permission to track users across other apps and services.

Many users say no. That’s already reduced how much third-party data advertisers can access on mobile.

Put together, these changes make it harder to rely on third-party data for audience building, retargeting, and attribution.

With tracking restrictions tightening and third-party data becoming less reliable, more companies are shifting their focus to first-party strategies.

That means building direct relationships with customers and creating clear value in exchange for their data.

Most marketers understand that first-party data is the future, for both measurement and targeting.

The problem is, it’s not always obvious how to get started. There’s a lot of talk about the importance of first-party data, but not much on the practical steps needed to set up a working strategy.

Here’s how we’re approaching it.

💡 Pro Tip

We dive deeper into the four steps to building a first-party data strategy in our blog, but here’s a quick overview of each step and how it can help you create a high-impact first-party strategy.

You need to know where your users come from and what they do before they convert.

GA4 gives you high-level trends, but it’s not enough, it doesn’t retain PII, and it aggregates and samples data.

That makes it hard to tie conversions back to individual journeys.

We track UTM parameters, click IDs (like gclid, fbclid), and use cookies to identify sessions and users.

We do this with first-party tracking tags from Ruler Analytics, which lets us collect data at the user level and link it across sessions.

You end up with a full view of what each person did before they became a lead.

💡 Pro Tip

Ruler plays a key role in our first-party data strategy. It allows us to track each user journey at an individual level and link it to conversions and real people, which becomes essential later when connecting the dots between revenue and cost data. If you’d like to see how Ruler actually works, we’d be happy to walk you through it in a demo.

Book a demo for a breakdown of every step involved

Next, we log conversions – fills, calls, live chats, offline events – and link them back to the marketing interactions that drove them.

GA4 doesn’t track PII, so it can’t tell you who converted or what happened after.

Related: 8 limitations of Google Analytics 4 and how to overcome them

With Ruler in place, we send every conversion (plus its full marketing journey) to our CRM.

Now we know which lead came from which ad, email, or blog – and what happened after.

Once the lead’s in the CRM, we keep tracking.

We follow the journey through the sales funnel and see which campaigns actually drive revenue, not just leads.

This shows us what’s performing. Maybe Meta brings in a lot of leads that never convert, while Google brings in fewer but higher quality ones.

Or maybe a blog post is quietly generating high-value pipeline. This is how we move from lead gen to revenue attribution.

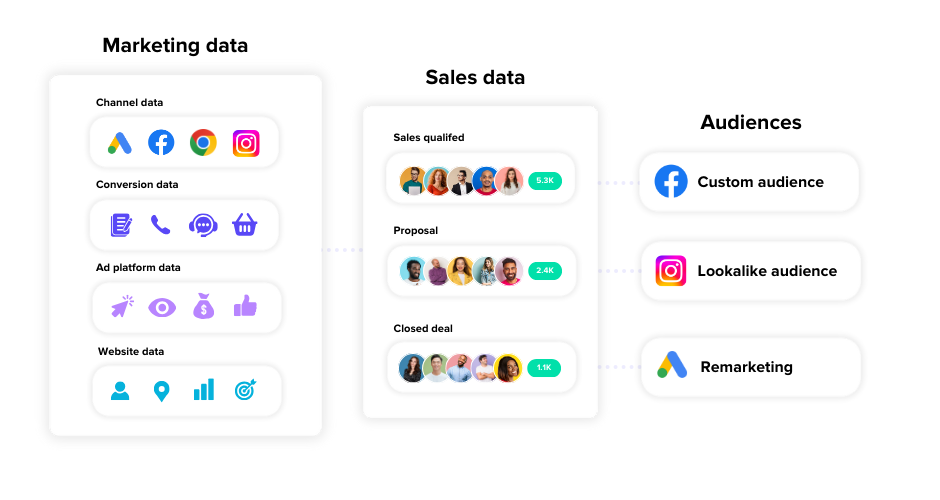

We also use this data to improve targeting, like building lookalike audiences from qualified leads or running upsell campaigns to customers further down the funnel.

The last step is layering in cost data. Without it, you don’t know what you’re paying for results.

Platforms like Google and Meta will both take credit for the same conversion unless you correct for it.

We bring spend into our tracking setup so we can calculate true performance: blended ROAS, actual customer acquisition cost, lifetime value.

That gives us a cleaner picture of what each channel delivers, and where to put the next pound or dollar.

💡 Pro Tip – Probabilistic modelling to fill in the gaps

First-party data is essential, but it doesn’t tell the whole story. Deterministic first-party tracking captures clear signals like clicks, but misses out in environments where engagement happens without them – think TikTok or Instagram. That’s where probabilistic models help. Ruler’s DDA + Impression Model combines deterministic click data with impression-based inputs, using principles from marketing mix modeling to fairly distribute credit across the full customer journey – including those hard to track channels. Our blog post on impression modelling explains the methodology in more detail.

Tools like Ruler help build a strong first-party data setup, but they’re not the only option. There are more manual ways to collect first-party data that can feed into both targeting and measurement.

Web forms: Simple, but effective. Web forms collect data directly from users who are actively engaging with your site. You can capture basic identifiers like name, email, and phone number. You can also ask for context – like “How did you hear about us?” – to add a qualitative layer. This gives you data you can act on. If a pattern emerges (e.g. most leads mention LinkedIn), that’s a signal to reallocate spend or refine your audience targeting.

User accounts: If your product supports it, logged-in user systems give you consistent identifiers and a deeper profile. Registration usually includes contact info and sometimes location or payment data. Over time, account activity builds a behavioural profile – what users view, what they buy, how often they return. You can use this data to personalise experiences and to build audiences that match actual customer traits, not assumptions.

Surveys and polls: Surveys allow you to ask directly. What matters to your audience? What are they trying to solve? What are their preferences? When structured well, this data is specific, relevant, and permissioned. It won’t scale like clickstream data, but it gives you high-quality input that’s hard to get elsewhere.

Customer feedback and reviews: Feedback, whether in a structured review or a support message, is first-party data. It reflects how real users experience your product or service. You can mine this data for themes and patterns: what users value, where they get stuck, what they want next. It’s not just for product teams. Marketers can use it to adjust messaging, build better audience segments, or spot gaps in positioning.

The debate between first-party and third-party data isn’t new, but the context has changed.

With privacy regulations tightening and browser restrictions evolving, third-party data is losing both reliability and value.

What used to work no longer holds up.

First-party data, by contrast, is more accurate, more relevant, and more compliant. It gives you direct insight into how people interact with your brand, and it’s data you own.

That makes it more dependable for both measurement and targeting.

At Ruler, we’ve built our first-party data strategy to give us a complete view of the customer journey – from first click to closed deal.

We track individual-level marketing source data, tie it to conversions, follow leads through the sales pipeline, and bring in cost data to calculate true ROI and ROAS.

Also, we use that same data to create high-value signals for ad platforms, so we can build custom audiences based on real outcomes, not guesses.

If you want to see how this works in practice, book a demo. We’ll walk you through it.