Are you a marketer in the finance industry? This blog shares key financial services marketing statistics that you’ll need to get more out of your marketing in 2023.

For the finance industry, lead generation and offline conversions are key. But, according to Blue Fountain Media, more than 50% of banks either do not measure their marketing ROI, or only measure it in less than 25% of their campaigns.

And, despite aggressive spending on paid advertising, many financial services marketers don’t have attribution in place to measure their return on ad spend. In fact, we found that 42% of marketers don’t use an attribution tool at all.

When leads and customers are searching online and converting over the phone, due to COVID, lead tracking through the entire customer journey is essential.

💡 Pro Tip

Download the full conversion benchmark report for the financial industry here to learn how users interact with businesses and via which channels.

To support marketers working in the financial services industry, we decided to analyse millions of data points in our own system to find conversion rate averages and other key statistics by industry.

Here are some of our major findings for the financial services industry.

Marketing in the financial industry isn’t easy, but some of our clients made it seem easy. We found that top performers in the industry were converting at a rate of 23%.

On average, however, this dropped to around 4.3%. While there are hurdles to lead generation in the financial services industry, it’s clear that with the right tools in place you can achieve great results.

Our analysis found that 26% of traffic to financial services sites came from direct traffic. We know that word of mouth marketing is important for the finance industry, just like it is for legal and professional services.

We also found out that the financial services best performing channel for conversions was referrals. This further highlights just how important word of mouth is.

Referral traffic could be another site recommending your services and linking to you, or it could be a local listings site. Either way, it’s important to understand and optimise based on what others are saying about your business.

While conversions in the finance industry tend to happen offline, many of these customers start their journey online.

As of 2020, searches for ‘banks near me’ rose a massive 60%. This highlights the importance of local SEO for financial services like accountants and financial advisors. And our analysis backed up how important organic SEO is.

We found that 41% of web traffic to the finance industry came from organic search.

And another 24% came from paid search, highlighting the importance of being found for your keywords (whether that’s organically or not).

At the end of 2021, there was an estimated 3 billion mobile banking app users worldwide. With such high demand comes the opportunity for banks to attain more customers. And, this trickles down to smaller finance offerings too. Financial services advertising spend dwindled in 2020 but is projected to increase by $3.94 billion from 2020 to 2021, according to eMarketer.

But remember, financial services keywords are among the most expensive in Google Ads and Bing Ads and can cost upwards of $50 per click.

So, when investing in paid search to drive traffic and conversions, you’ll need to make sure you’re properly tracking your revenue attribution to ensure you’re getting the most from your paid ads.

We found that email had a conversion rate of 5.8% for the financial services industry. This highlights key opportunities for financial services marketers looking to drive more conversions.

By investing in highly targeted email marketing, you can hit leads with the right message at the right time.

And remember, those signing up for your email marketing are showing a keen interest. Unlike other industries, like automotive or legal, finance doesn’t depend on the consumer hitting certain requirements e.g. needing a new car.

With finance, you can offer great products and lead users to buy new products or upgrade existing ones.

But remember, get personalised with your email. According to Forrester, 48% of marketers have provided, or expect to provide, enhanced customer experiences as a result of scaling conversation intelligence.

This means scraping data from phone calls to create highly segmented and targeted messaging. And this impacts email marketing.

Overall, we found that the financial services industry had an average conversion rate of 4.3%. But, within our analysis, some players were seeing a conversion rate of 23%.

Many major players in the financial services industry are seeing lower conversion rates due to a lack of offline conversion tracking.

Want to know which channels have the best conversion rate in the financial services industry? We’ve listed them all for your ease.

Coming in first is referral at 7% followed by paid search at 6% (that’s across Google, Bing and Yahoo).

Next is email with a conversion rate of 5.8%, followed by organic search at 4.7% and direct at 4.4%.

After that is organic social with a conversion rate of 4.7%. Lastly is paid social with a conversion rate of 1%.

But remember, these are industry averages. What might work well for other financial services might not work best for you.

Did you know that if you work in the financial services industry, you could be missing up to 19% of your data? That’s because we found in our conversion benchmark report that 19% of leads call finance services.

Without call tracking and marketing attribution, you can’t then associate that call with a closed sale.

But the same is true for your forms. While you might be able to track lead volume from forms, do you know how to connect a form fill back to your marketing campaigns?

But that’s where we come in.

Our marketing attribution tool allows you to close the gap between your sales and your marketing.

Related: Complete guide to marketing attribution

The difficulty for marketers in the financial services industry is generating more high-quality leads.

But remember, it’s not impossible. With an attribution tool like ours, you can get accurate, automatic data where you need it most. Because the only way to know what’s truly working is by adopting a marketing attribution tool yourself so you can interpret your own data, not somebody else’s.

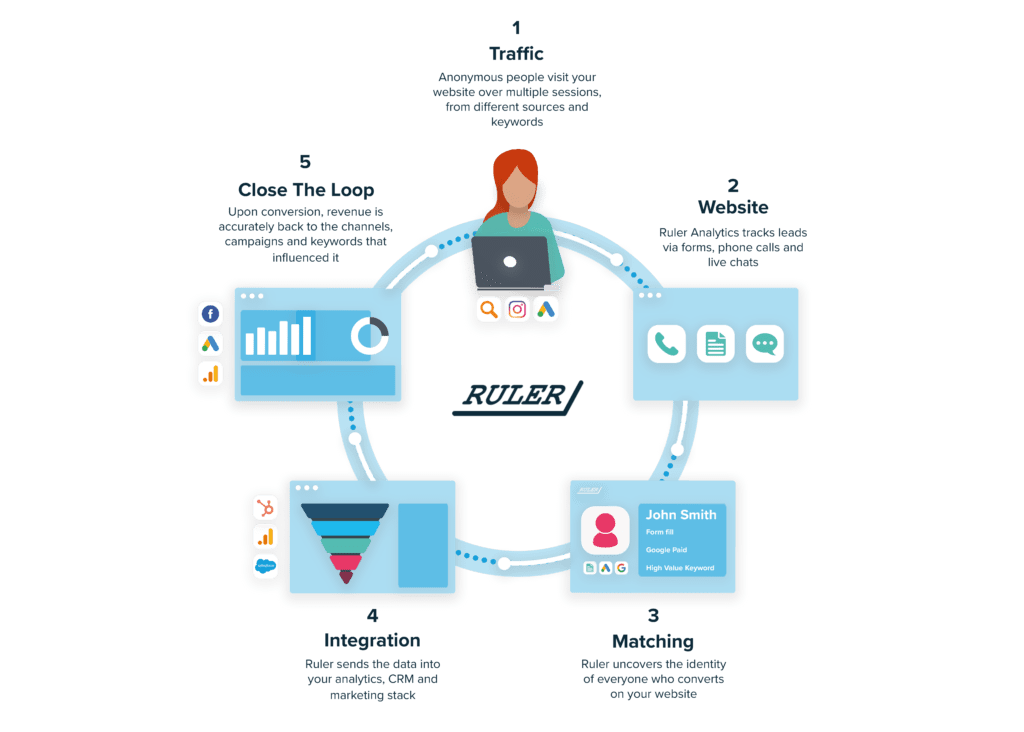

Ruler works like this:

Sounds good? See Ruler in action by booking a demo with our attribution experts.